Obamacare,

aka the Affordable Care Act (ACA) has already proven to have been sold to the

American electorate based on falsehoods, to be massively complex, and not to be

affordable to either the middle class or those who have been granted subsidies.

Now comes the 2015 tax-filing season, and a new set of costs on top of all the

others.

Beginning

with your 2014 tax returns, every taxpayer and tax preparer will need to become

health insurance savvy as every taxpayer needs to be evaluated as to:

(a) Are they required to have

health insurance (the “individual mandate”)?

(b) If required to do so, did they have

health insurance (either through an employer, through the exchange, or

through an individual policy)?

(c) Did the insurance meet the

minimum requirements for coverage?

(d) Were all family members (typically

includes children under 18) covered?

(e) If purchased through an

exchange/marketplace, were they entitled to a premium credit; did they receive

a premium credit; and if so, how much?

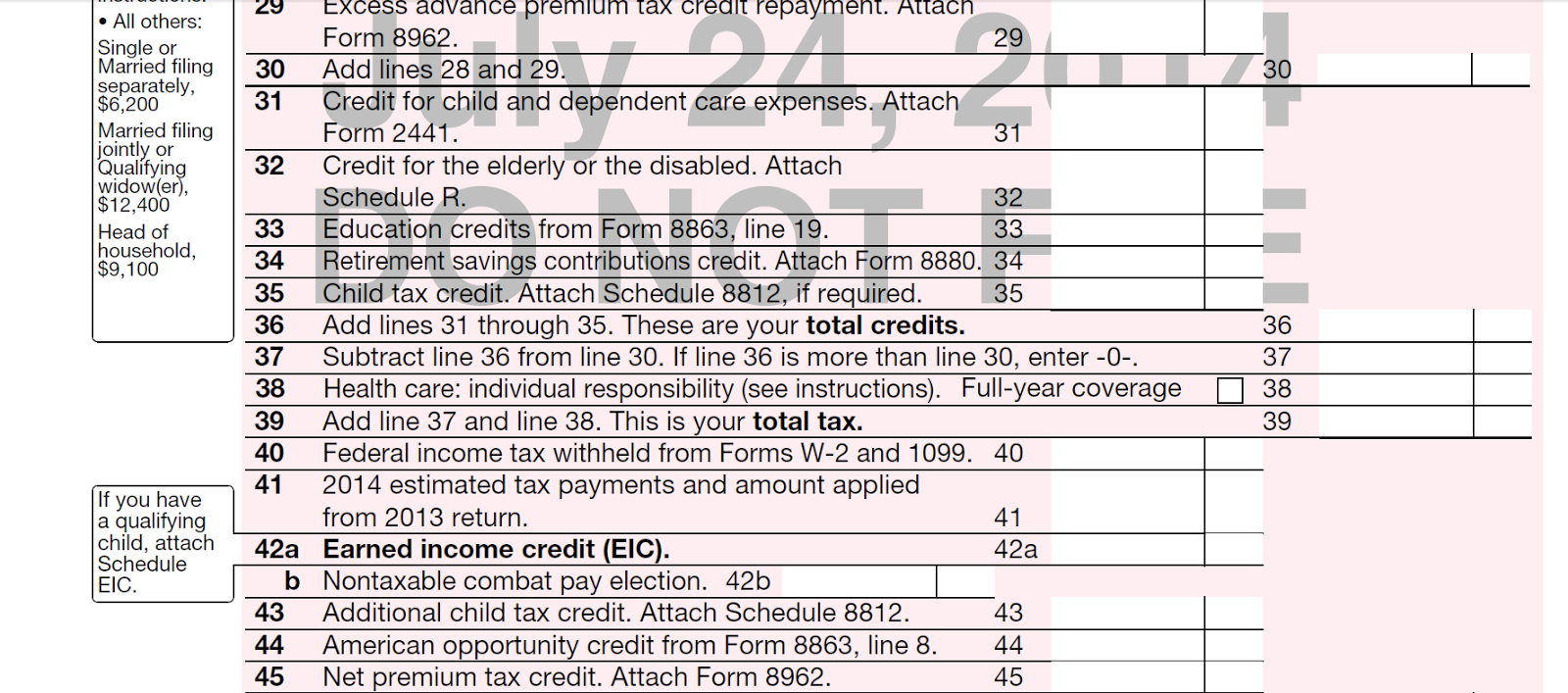

You

will need the answers to those questions if you are going to be able to fill in

the below boxes on the revised form 1040! Pay special attention to line

29, 38, and 45.

Line

29 – if the taxpayer purchased insurance through an exchange and received a

subsidy (premium credit) that was GREATER than what they were entitled to, then

the EXCESS (repayment) of the credit received over the allowable credit will be

recorded here and added to their other taxes.

Line

38 – this is where we will have to record the PENALTY the taxpayer will pay if they

were NOT exempt from having insurance, and (a) they had no coverage for part of

or the entire tax year, or (b) had substandard coverage (a policy that did

not meet the minimum requirements for coverage).

Line

45 – if they either received NO subsidy, or their subsidy (that was based

upon their 2012 income via the exchange) was LESS than they were entitled

to, then they would have a CREDIT here for the difference between their

allowable subsidy and what they actually received.

Now

in order to fill in those three blanks, you will almost certainly need to fill

in proposed form 8962. The schedule will need to be filled out by every

taxpayer who purchased insurance through an exchange, and

(a) received a subsidy, or (b) is eligible for a premium tax credit! It would

be fair to say that the individuals who are most likely to need this form or

those least likely to understand how to fill it out.

That

means the folks are going to need their tax preparer to fill it out. Assuming

that tax preparers are still desiring to make a profit from helping taxpayers

fill out their tax returns, the cost of filling out additional forms will

result in higher costs to the taxpayer.

Remember

that the marketplace formula for calculating the advance premium credit uses

the 2012 income of the taxpayer in determining their

credit. If their income in 2014 was HIGHER than 2012, then most likely

they received an excessive credit toward their premium –

and it will be payback time on the 2014 return!

Here

is the draft form 8962. Remember – it is ONLY required if

insurance was purchased through the marketplace – period!

Any

employer plan or individual plan has no credit applicability.

HOWEVER,

a penalty (individual mandate) MAY still be required if the employer’s

insurance was sub-standard (not up to par with the least costly Obamacare plan)

or coverage was not in place for the full year, or some family members were not

covered (who had to be covered under the rules).

None

of the above takes into consideration the rules for businesses, corporations,

non-profits, and tax exempt organizations, and costs they must pay their tax

preparers to insure compliance with the new rules and/or pay various fines for

failure to comply.

If

you are having difficulty with your 2014 tax return, and would like help

understanding all the latest changes, the tax preparation division of

Demetriou, Montano & Associates stands ready to help. Call 888-987-1040 and

discuss your needs with us today.